Did everything just change? Climate had a big day this week

Decoding Exxon, Chevron & Shell, oh my

Three big things happened within a matter of hours this week. Climate activists & journalists have already hailed as an enormous change. A sea change, if you will. Shell was ordered by a Dutch court to cut their emissions by 45% by 2030 - including Scope 3, which would mean they would have to extract less oil, leaving it in the ground. At least 2 new members were elected to Exxon’s board representing Engine No. 1, an activist investor arguing that the company’s climate change plans (or lack thereof) were endangering profits. And shareholders agreed. And at Chevron, a shareholder initiative calling for the company to cut it’s Scope 3 emissions passed by 61%.1

The question I pose in the title of this article is the key one. Did everything change?

No. (At least not yet. Not so fast. But this is still a very big deal.)

It’s always tempting to spot inflection points around you, but if history teaches us anything, it’s that it’s awfully hard to figure out the big moment of change when you’re in the middle of it. Much could go awry with these three victories for climate advocates - the legal decision could be tied up in appeals for years - Shell has already said it will appeal, and it certainly has deep pockets. Even the shareholder votes can be challenged by management, and if management does not begin to act in accordance with shareholder votes they will then need to be removed by the board, a long tortuous process.

So while these three events are each individually remarkable, and together in the space of a day make for a headline grabbing feel-good moment, they do not guarantee we are on the road to “success”. The many Twitter posts expressing relief that “we might actually make it” are likely premature. We actually need to cut emissions, and while the Exxon & Chevron votes make it clear that there is the will to do so among a population (oil shareholders) whose climate bona fides might have been the subject of skepticism, I’ll believe it when I see it. Even if these actions begin to take effect at the large public oil companies, there remains real danger that these companies will start to launder their portfolios by selling their worst assets to private companies, removing those wells & refineries from the scrutiny of public markets.

However, despite my skepticism, I am buoyed by the outcome, and I’d like to lay out why.

If you’ve been following my writing on the “climate short”, you’ll see that I believe that business cannot solve the climate catastrophe by itself - only government can coordinate action on a large enough scale to do so. However, some branches of government (viz. Dutch courts in shell decision, recent German Supreme Court decision) are beginning to put teeth behind the government actions. Shareholders are beginning to articulate that they believe that company profits are at risk (viz. Exxon & Chevron decisions) from inaction - which suggests they believe as I do that the cost of emissions are going to rise (or conversely the profits accruing to those who emit will fall), and rapidly enough that we will see impact on current shareholders.

Shareholders are beginning to move from the first phase of ESG climate activism (eg, divest - don’t hold the worst assets like coal) to the second phase, driving behavior (eg, be invested and vote) which is going to be far more effective. Soon I’ll cover the coming third phase when activist investors and impact investors start to short the stocks of those whose carbon intensity is the highest. I’d predict we’ll soon see the move from “don’t buy” to “buy and vote” and then on to “sell short”.

If markets generally are underestimating the financial risk of climate, this week and these three decisions represent one chapter of the awakening - the recognition that governments can and will act, that the cost of inaction will be higher than action, and that shareholders can make a difference. The toolkit for change is not unknown, but it is just being put into action again after a long period on the shelf.

As a friend in the investment community said of the Exxon board battle: “this is the first thing to challenge my cynicism. These dudes2 spent $30m on the proxy fight!” I couldn’t agree more.

The rest of the existential emitters are clearly watching. I’d predict that boards, CEOs and CFOs beyond those most existential emitters (oil, gas & coal) to the next most intensive (ie, airlines, shipping, steel, etc) are beginning to imagine how this type of action will play out for them. The most forward-looking of the less intensive with consumer brands (ie, retail, apparel, software, consumer goods, appliances, …) are already thinking about how to get ahead of these changes.

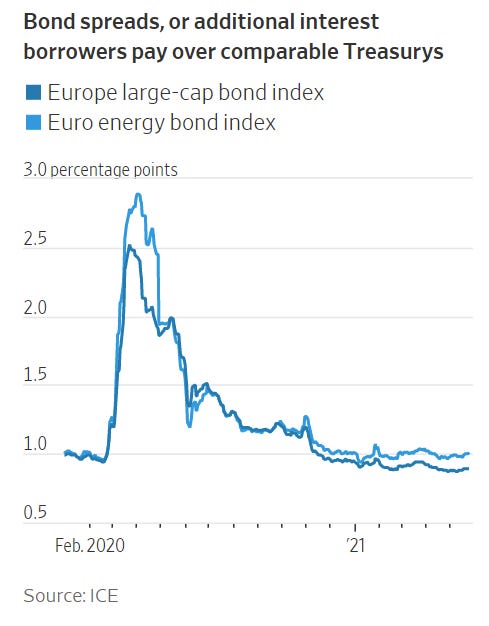

Regardless of how these three specific examples play out, even if they are mired in litigation and obstructionist tactics for years, the shot has been fired across the bow. Debt and equity investors alike don’t like being on the wrong side of history - or returns. And if this week’s news is nothing else, it’s an indication that turning a blind eye to climate change in your investment portfolio WILL put you on the wrong side of history (& returns). As more investors think twice, costs of capital will rise. They already are, as the spread between EU energy companies vs. general large cap company bond interest rates show3. For energy companies, who if nothing else are exceptional deployers of CapEx, a gradually rising cost of capital will do far more damage than the flash of PR pain from yesterday’s headlines.

So no, the world didn’t just change entirely in one full swoop. We haven’t by any stretch of the imagination reached peak emissions and shown that we can maintain a downward trajectory. But we just saw that the rules of capitalism and finance, which got us here, can in fact help get us there. We need more weeks like this week. Let’s hope4 they come quickly.

You can read about what happened in far more detail many other places - this Politico article is a great place to start. Everyone but everyone has an article with the details and their hot take. This one you’re reading now is mine.

To be fair, ”dudes” sounds like very bro-ey language, and my anonymous friend who texted me would be horrified to hear me call the phrase out, but I include it as-is, because it’s representative of the deluge of “holy crap, this might be real” messages that I’ve received over the past couple days. And I thoroughly feel the same way.

See WSJ article - which I think gets it mostly right, but doesn’t fully dive into the cost of capital issue as the driving force I believe it will be.

Note that when I say “hope”, I mean so for many reasons - including not only the fate of the planet, but also shareholder value. I can hold those two thoughts and motivations in my head at the same time.